Your 4 retirement rule calculator images are ready. 4 retirement rule calculator are a topic that is being searched for and liked by netizens today. You can Get the 4 retirement rule calculator files here. Find and Download all free photos.

If you’re looking for 4 retirement rule calculator pictures information connected with to the 4 retirement rule calculator topic, you have pay a visit to the ideal blog. Our website frequently gives you hints for refferencing the maximum quality video and image content, please kindly search and find more informative video content and graphics that fit your interests.

4 Retirement Rule Calculator. An important note for users (february 2022): For this rule, you would either need a low cost of living or additional income to. I�d love to hear from you. Over the last 8 years, i�ve spent nearly $4000 hosting this website and never made a penny.

Source: pinterest.com

Source: pinterest.com

An important note for users (february 2022): The 4% rule refers to how much money you withdraw each year after you retire. For this rule, you would either need a low cost of living or additional income to. An important note for users (february 2022): I�ve been happy to provide a free service, but may need to shut the website down soon if i don�t.

Source: youtube.com

Source: youtube.com

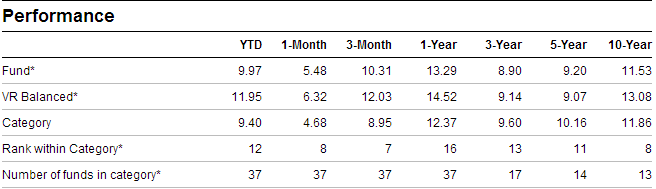

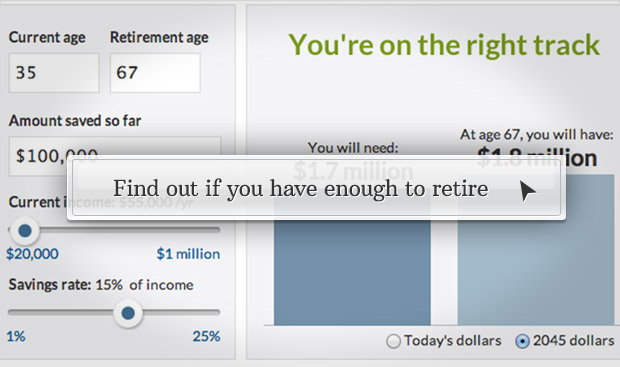

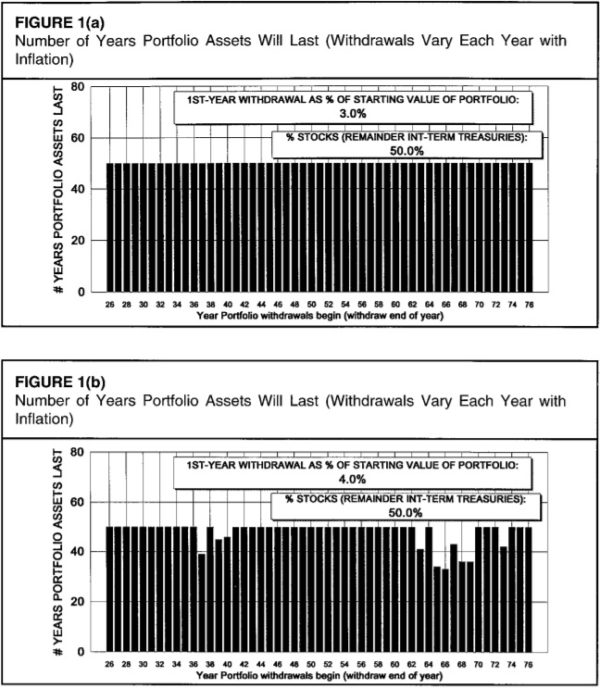

For this rule, you would either need a low cost of living or additional income to. Some experts claim that savings of 15 to 25 times of a person�s current annual income are enough to last them throughout their retirement. The 4% rule recommends the maximum amount you should spend in relation to your current retirement savings balance. I�d love to hear from you. If you like this site, email me at stephengower1@gmail.com.

Source: pinterest.com

Source: pinterest.com

I�ve been happy to provide a free service, but may need to shut the website down soon if i don�t. The rule assumes you start with $240,000 retirement savings and withdraw $12,000 each year for 20 years, or $1,000 per month. I�d love to hear from you. 4% rule of thumb vs. It states that you should use no more than 4% of the value of your portfolio of stock and bonds in the first year after you stop working.

Source: fors.vanaja.com.au

Source: fors.vanaja.com.au

For this rule, you would either need a low cost of living or additional income to. The rule assumes you start with $240,000 retirement savings and withdraw $12,000 each year for 20 years, or $1,000 per month. If you like this site, email me at stephengower1@gmail.com. Some experts claim that savings of 15 to 25 times of a person�s current annual income are enough to last them throughout their retirement. So, if your annual spending is $40,000, you need $1.

Source: indexcfd.com

Source: indexcfd.com

I�ve been happy to provide a free service, but may need to shut the website down soon if i don�t. For example, if you have $100,000 when you retire, the 4% rule would say you could withdraw about 4% of that amount. The calculations here can be helpful, as can many other retirement calculators out there. The rule assumes you start with $240,000 retirement savings and withdraw $12,000 each year for 20 years, or $1,000 per month. For this rule, you would either need a low cost of living or additional income to.

Source: lrbtheblog.wordpress.com

Source: lrbtheblog.wordpress.com

So, if your annual spending is $40,000, you need $1. With the rule of 25, you multiply your estimated annual expenses to determine how big your nest egg should be. I�d love to hear from you. For this rule, you would either need a low cost of living or additional income to. The 4% rule refers to how much money you withdraw each year after you retire.

![Wintax Calculator 0.18.4 Crack Activation Key Download Source: dorisclothing.com

Some experts claim that savings of 15 to 25 times of a person�s current annual income are enough to last them throughout their retirement. Over the last 8 years, i�ve spent nearly $4000 hosting this website and never made a penny. So, if your annual spending is $40,000, you need $1. With the rule of 25, you multiply your estimated annual expenses to determine how big your nest egg should be. The 4% rule refers to how much money you withdraw each year after you retire.

![Tax Calculator For FY 201920 [AY 202021] Excel Download Tax Calculator For FY 201920 [AY 202021] Excel Download](https://www.apnaplan.com/wp-content/uploads/2019/03/Income-Tax-Calculator-for-AY-2020-21.png) Source: apnaplan.com

Source: apnaplan.com

4% rule of thumb vs. If you like this site, email me at stephengower1@gmail.com. For example, if you have $100,000 when you retire, the 4% rule would say you could withdraw about 4% of that amount. Some experts claim that savings of 15 to 25 times of a person�s current annual income are enough to last them throughout their retirement. Over the last 8 years, i�ve spent nearly $4000 hosting this website and never made a penny.

Source: fool.com

Source: fool.com

I�d love to hear from you. The 4% rule refers to how much money you withdraw each year after you retire. If you like this site, email me at stephengower1@gmail.com. Annual expenses x 25 = total retirement portfolio value necessary. For this rule, you would either need a low cost of living or additional income to.

Source: themoneytools.org

Source: themoneytools.org

It states that you should use no more than 4% of the value of your portfolio of stock and bonds in the first year after you stop working. Of course, there are other ways to determine how much to save for retirement. The 4% rule refers to how much money you withdraw each year after you retire. Some experts claim that savings of 15 to 25 times of a person�s current annual income are enough to last them throughout their retirement. So, if your annual spending is $40,000, you need $1.

Source: msfinancialliteracy.com

Source: msfinancialliteracy.com

Of course, there are other ways to determine how much to save for retirement. The rule assumes you start with $240,000 retirement savings and withdraw $12,000 each year for 20 years, or $1,000 per month. So, if your annual spending is $40,000, you need $1. Over the last 8 years, i�ve spent nearly $4000 hosting this website and never made a penny. An important note for users (february 2022):

Source: berginnutcompanypepitas14ouordernow.blogspot.com

Source: berginnutcompanypepitas14ouordernow.blogspot.com

The 4% rule refers to how much money you withdraw each year after you retire. With the rule of 25, you multiply your estimated annual expenses to determine how big your nest egg should be. Over the last 8 years, i�ve spent nearly $4000 hosting this website and never made a penny. So, if your annual spending is $40,000, you need $1. It states that you should use no more than 4% of the value of your portfolio of stock and bonds in the first year after you stop working.

Source: msfinancialliteracy.com

Source: msfinancialliteracy.com

I�d love to hear from you. The 4% rule recommends the maximum amount you should spend in relation to your current retirement savings balance. I�ve been happy to provide a free service, but may need to shut the website down soon if i don�t. The 4% rule refers to how much money you withdraw each year after you retire. The rule assumes you start with $240,000 retirement savings and withdraw $12,000 each year for 20 years, or $1,000 per month.

Source: intouchemr.com

Source: intouchemr.com

The calculations here can be helpful, as can many other retirement calculators out there. An important note for users (february 2022): The 4% rule refers to how much money you withdraw each year after you retire. The 4% rule recommends the maximum amount you should spend in relation to your current retirement savings balance. 4% rule of thumb vs.

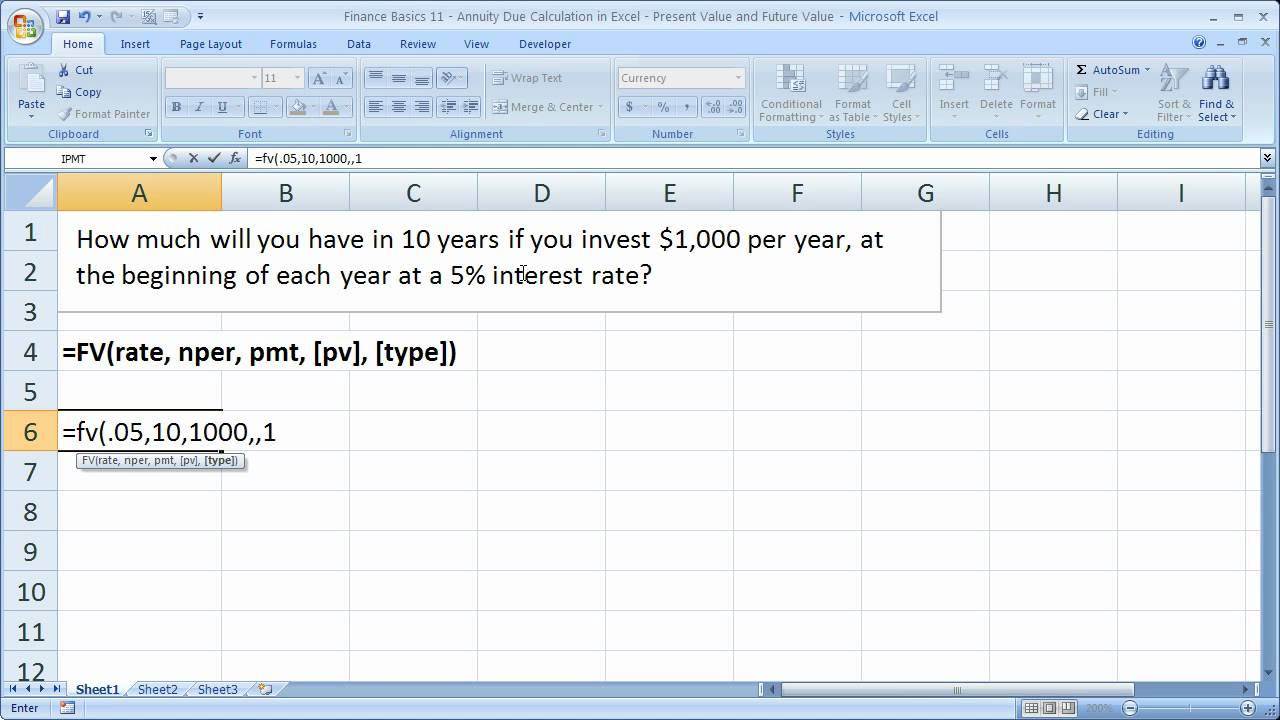

Source: youtube.com

Source: youtube.com

The calculations here can be helpful, as can many other retirement calculators out there. Over the last 8 years, i�ve spent nearly $4000 hosting this website and never made a penny. For this rule, you would either need a low cost of living or additional income to. So, if your annual spending is $40,000, you need $1. Annual expenses x 25 = total retirement portfolio value necessary.

Source: pinterest.com

Source: pinterest.com

The calculations here can be helpful, as can many other retirement calculators out there. The calculations here can be helpful, as can many other retirement calculators out there. So, if your annual spending is $40,000, you need $1. It states that you should use no more than 4% of the value of your portfolio of stock and bonds in the first year after you stop working. Over the last 8 years, i�ve spent nearly $4000 hosting this website and never made a penny.

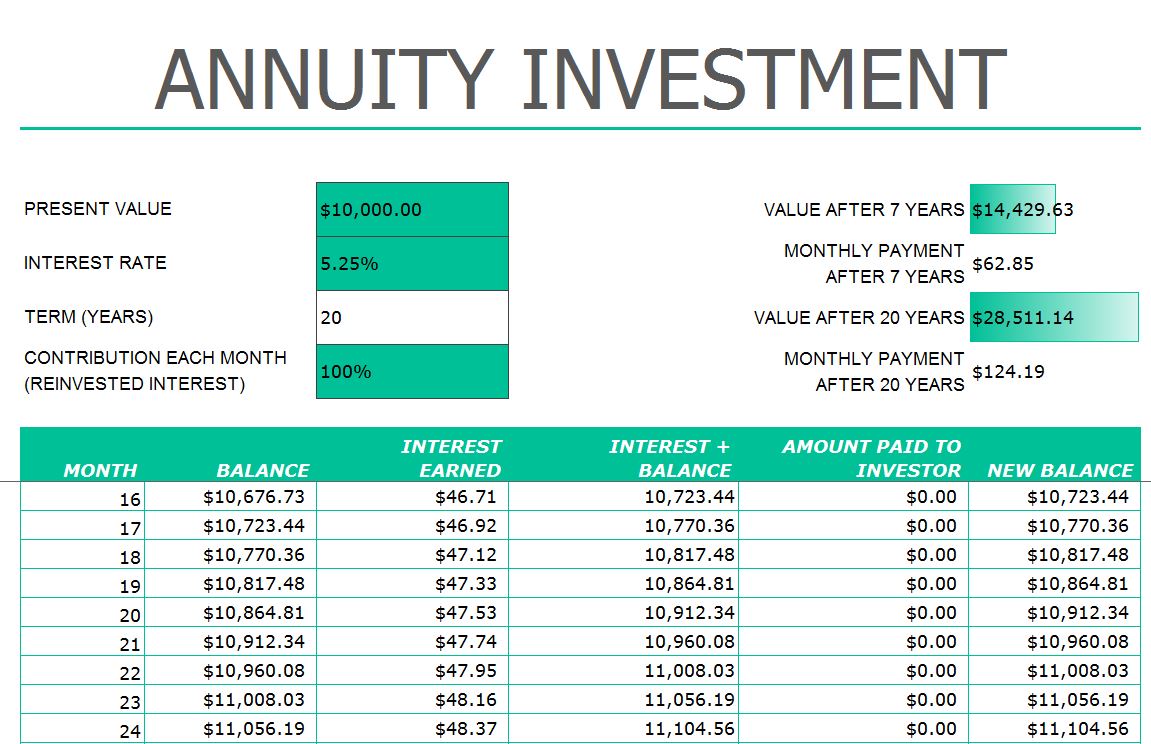

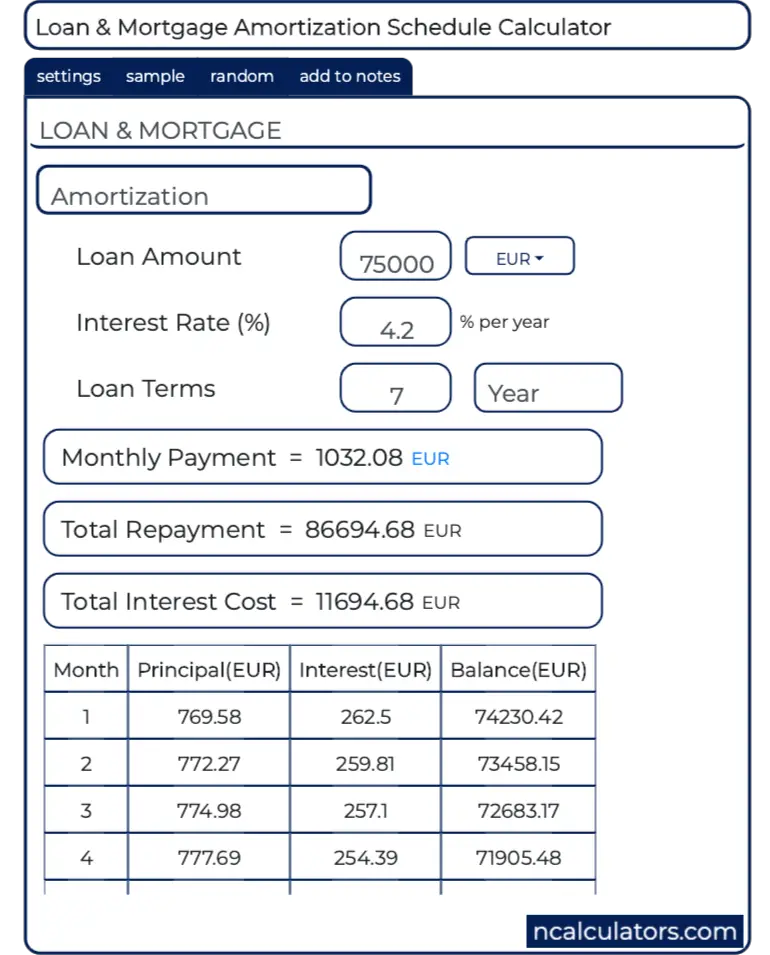

Source: ncalculators.com

Source: ncalculators.com

Over the last 8 years, i�ve spent nearly $4000 hosting this website and never made a penny. With the rule of 25, you multiply your estimated annual expenses to determine how big your nest egg should be. 4% rule of thumb vs. Over the last 8 years, i�ve spent nearly $4000 hosting this website and never made a penny. If you like this site, email me at stephengower1@gmail.com.

Source: fool.com

Source: fool.com

The rule assumes you start with $240,000 retirement savings and withdraw $12,000 each year for 20 years, or $1,000 per month. The rule assumes you start with $240,000 retirement savings and withdraw $12,000 each year for 20 years, or $1,000 per month. The 4% rule recommends the maximum amount you should spend in relation to your current retirement savings balance. Some experts claim that savings of 15 to 25 times of a person�s current annual income are enough to last them throughout their retirement. If you like this site, email me at stephengower1@gmail.com.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title 4 retirement rule calculator by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.